- Retrait en 2 heures

- Assortiment impressionnant

- Paiement sécurisé

- Toujours un magasin près de chez vous

- Retrait gratuit dans votre magasin Club

- 7.000.0000 titres dans notre catalogue

- Payer en toute sécurité

- Toujours un magasin près de chez vous

305,45 €

+ 610 points

Description

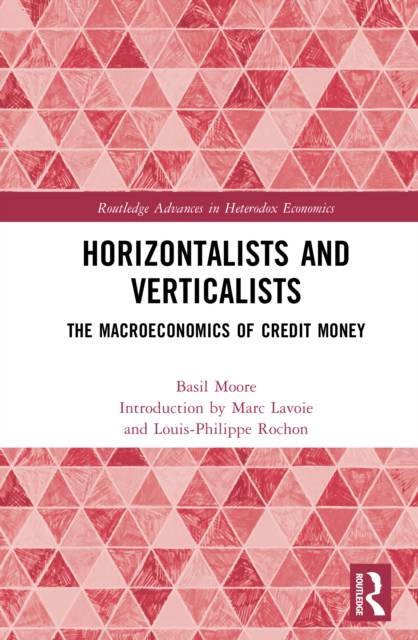

This anniversary edition of Basil Moore's classic work features the original text along with an extensive new introduction and foreword. Providing much of the theoretical foundation on which post-Keynesian endogenous money and Modern Monetary Theory were subsequently developed.

Spécifications

Parties prenantes

- Auteur(s) :

- Editeur:

Contenu

- Nombre de pages :

- 364

- Langue:

- Anglais

- Collection :

Caractéristiques

- EAN:

- 9781032720647

- Date de parution :

- 07-11-25

- Format:

- Livre relié

- Format numérique:

- Genaaid

- Dimensions :

- 156 mm x 234 mm

- Poids :

- 739 g

Seulement chez Librairie Club

+ 610 points sur votre carte client de Librairie Club

Les avis

Nous publions uniquement les avis qui respectent les conditions requises. Consultez nos conditions pour les avis.