- Retrait en 2 heures

- Assortiment impressionnant

- Paiement sécurisé

- Toujours un magasin près de chez vous

- Retrait gratuit dans votre magasin Club

- 7.000.0000 titres dans notre catalogue

- Payer en toute sécurité

- Toujours un magasin près de chez vous

Description

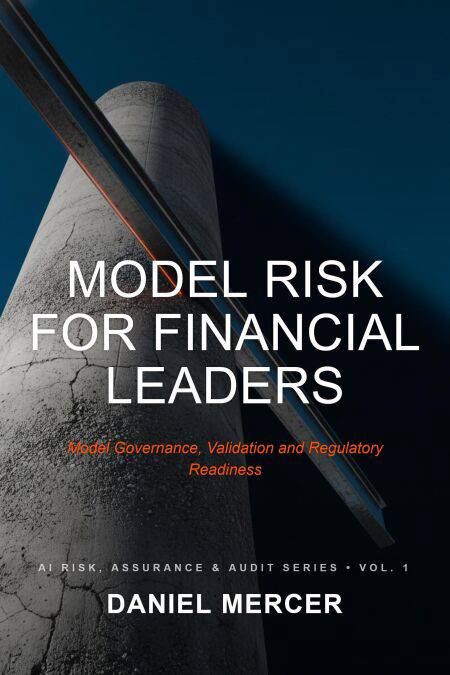

Artificial intelligence and advanced analytics are now embedded in core financial decision-making. With that reliance comes heightened regulatory scrutiny, operational risk, and accountability at the executive level.

Model Risk for Financial Leaders is a practical guide for finance executives, risk leaders, and audit stakeholders responsible for governing analytical and AI-driven models across regulated financial environments. The book translates technical model risk management concepts into executive-level governance actions aligned with real regulatory expectations.

This volume focuses on how to design, assess, and oversee model governance programs that withstand internal audit, supervisory review, and board-level scrutiny. Drawing from established Model Risk Management (MRM) principles and risk quantification approaches such as FAIR, it bridges the gap between theory and operational execution.

Key areas covered include:

Model inventory, tiering, and ownership structures Governance operating models for AI and analytics Independent validation and effective challenge practices Documentation standards regulators expect to see Audit-ready checklists for model lifecycle controls Regulatory alignment with OSFI and comparable supervisory bodiesWritten in an analytical yet practical tone, this book equips financial leaders to make informed decisions about model risk without requiring deep technical expertise. It is designed to support regulatory readiness, defensible governance, and sustainable use of advanced models in financial services.

Spécifications

Parties prenantes

- Auteur(s) :

- Editeur:

Contenu

- Langue:

- Anglais

- Collection :

Caractéristiques

- EAN:

- 9798231450534

- Date de parution :

- 04-01-26

- Format:

- Ebook

- Protection digitale:

- /

- Format numérique:

- ePub

Seulement chez Librairie Club

Les avis

Nous publions uniquement les avis qui respectent les conditions requises. Consultez nos conditions pour les avis.